What is SIP: Systematic Investment Plans (SIPs) have revolutionized how Indians invest in mutual funds. If you’ve ever felt confused by financial jargon or unsure where to start your investment journey, SIP is your answer. This detailed guide is designed especially for beginners who want to understand SIP from the ground up.

By the end of this article, you’ll know:

- What SIP really means

- How it works (with real examples)

- Why it’s ideal for new investors

- Mistakes to avoid

- How to plan with our free SIP Calculator

Let’s dive into the world of smart investing!

What is SIP? – The Full Form and Meaning

SIP stands for Systematic Investment Plan. It’s a disciplined investment strategy where you invest a fixed amount of money at regular intervals, usually monthly, in a mutual fund scheme.

Think of it as a recurring deposit, but in mutual funds. Instead of saving money in a bank with low returns, you’re investing in the market, potentially earning much higher returns over time.

Why SIP is the Perfect Starting Point for Beginners

SIP is designed for people who:

- Want to start investing with small amounts (as low as ₹500/month)

- Don’t have time to track the stock market

- Prefer consistent savings over risky bets

- Want long-term wealth creation

Here’s why SIP stands out:

| Feature | Benefit |

|---|---|

| Affordable Entry Point | Start with as low as ₹500/month |

| Auto-Debit Convenience | Set it and forget it |

| Rupee Cost Averaging | Buys more when markets are low |

| Power of Compounding | Small amounts grow into huge wealth |

| Emotional Discipline | Avoids panic selling during market drops |

How SIP Works – With Real-Life Analogy

Let’s say you love mangoes. You buy mangoes every week with ₹100.

- Week 1: ₹100/kg – You get 1kg

- Week 2: ₹50/kg – You get 2kg

- Week 3: ₹200/kg – You get 0.5kg

In the end, your average cost is balanced. This is rupee cost averaging – the heart of SIP.

When markets are high, SIP buys fewer units. When markets fall, SIP buys more. Over time, your average cost per unit reduces.

Real SIP Example

Suppose you invest ₹2000/month in a mutual fund. Here’s how unit purchases work:

| Month | NAV (₹) | Units Bought |

|---|---|---|

| Jan | 20 | 100.00 |

| Feb | 25 | 80.00 |

| Mar | 18 | 111.11 |

| Total | — | 291.11 Units |

Average NAV = ₹206.66 but you paid only ₹2000/month. Your per-unit cost = ₹20.85 — cheaper than average.

This is the advantage of investing regularly vs one-time.

SIP is a Strategy, not a Product

Let’s be clear: SIP is not a mutual fund scheme. It’s a way to invest.

You can start an SIP in:

- Equity Funds (high growth)

- Debt Funds (stable returns)

- ELSS (tax-saving)

- Index Funds (market-linked)

You choose the fund, SIP is the method.

Benefits of SIP – Why it Beats Traditional Saving

- Starts Small, Grows Big: ₹500/month over 20 years at 12% = ₹4.94 lakhs (on ₹1.2 lakhs invested)

- Emotion-Free Investing: Avoid panic when the market crashes

- Saves Tax: Invest in ELSS funds via SIP and claim up to ₹1.5L deduction

- Automatic Wealth Creation: Works while you sleep

Power of Compounding – The 8th Wonder

Albert Einstein called compounding the 8th wonder of the world. SIP uses it beautifully.

Let’s say you invest ₹5000/month for 20 years @12% returns:

- Total Invested = ₹12 lakhs

- Final Value = ₹49.96 lakhs

The secret? Interest on interest, compounding monthly.

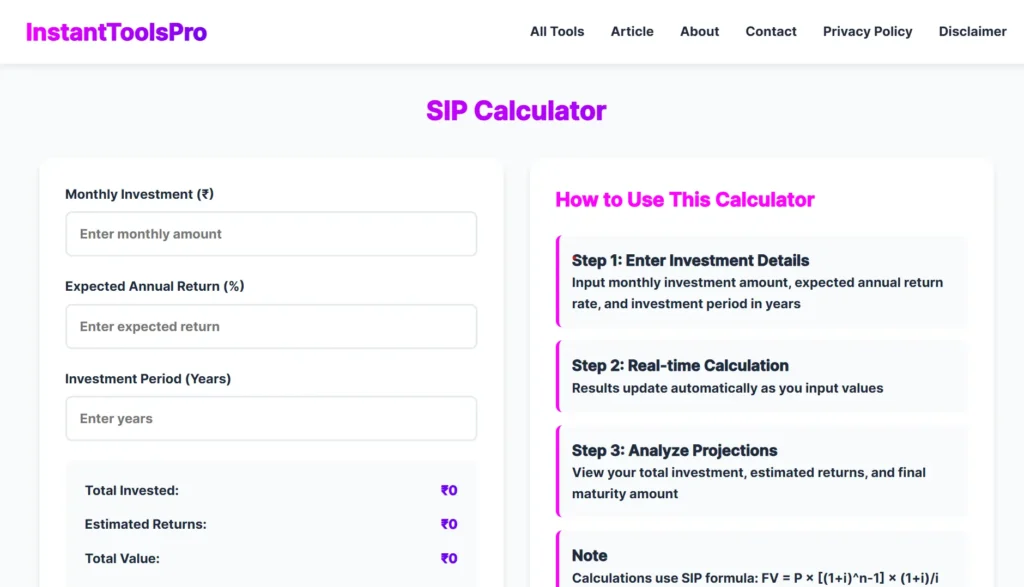

Use a SIP Calculator (Free on InstantToolsPro)

Planning your SIP is super easy with our tool:

Free SIP Calculator – Click Here

You can:

- Estimate returns

- Set financial goals

- Plan step-up SIPs

- Compare multiple funds

No sign-up. No ads. Just fast and accurate results.

Common SIP Mistakes to Avoid

- Stopping SIPs during market crashes – This is when you should continue!

- Expecting overnight results – SIP works only in the long term

- Choosing wrong mutual funds – Always research or consult a financial advisor

- Skipping SIP dates – Set auto-debit and relax

SIP Calculator: How to Plan Your Monthly Investments in 2 Minutes

How Long Should I Invest in SIP?

The longer, the better. SIP is a marathon, not a sprint. Here’s a quick look:

| Time Period | ₹5000/month @12% | Final Value |

|---|---|---|

| 5 years | ₹3.6 lakhs | ₹4.05 lakhs |

| 10 years | ₹6 lakhs | ₹11.6 lakhs |

| 20 years | ₹12 lakhs | ₹49.9 lakhs |

Who Should Start SIP?

- Students: Build the habit with just ₹500/month

- Salaried Employees: Ideal for monthly budgeting

- Freelancers: Set flexible SIPs based on income

- Homemakers: Contribute to financial planning

- Retirees: Choose debt SIPs for stable returns

SIP vs Other Investments

| Investment Type | Risk | Returns | Tax Benefits | Liquidity |

|---|---|---|---|---|

| SIP in Equity MF | Medium-High | High | Yes (ELSS) | Moderate |

| FD | Low | Low | Some | High |

| PPF | Very Low | Moderate | Yes | Low |

SIP is the only flexible option offering high growth + tax-saving + compounding.

Key Takeaways

- SIP = Smart, regular investing in mutual funds

- Works on rupee cost averaging & compounding

- Best for beginners, salaried class, long-term wealth

- Avoid emotional investing – stay consistent

What’s Next?

Ready to start? Use our Free SIP Calculator to plan your first investment.

In the next part of our series: “Types of SIPs: Equity, Debt, ELSS & More“

We’ll explore how long-term SIPs help beat inflation and how you can turn small monthly investments into crores.

Stay tuned!