Introduction: SIP is Not One-Size-Fits-All

SIP (Systematic Investment Plan) is a smart way to invest in mutual funds, but did you know there are different types of SIPs, each with unique features, risks, and benefits?

Whether you’re looking to save taxes, build long-term wealth, or reduce risk — choosing the right type of SIP is crucial.

In this guide, we’ll explore different types of SIPs in India, their features, pros and cons, and which one suits your financial goals the best.

1. Equity SIP – High Growth, High Risk

Equity SIPs invest in equity mutual funds, which further invest in shares of companies.

Ideal for: Long-term investors (5+ years)

Returns: 10% to 15% (market-dependent)

Risk Level: High

Tax: LTCG applicable after 1 year

Pros:

- Potential for higher wealth creation

- Power of compounding over long term

- Ideal for beating inflation

Cons:

- Risk of volatility in short term

- Requires patience and discipline

Example: Investing ₹5,000/month in an equity SIP for 10 years can grow to ₹10–12 Lakhs depending on market performance.

2. Debt SIP – Safe & Stable Returns

Debt SIPs invest in debt mutual funds (like bonds, debentures, government securities). They are relatively stable.

Ideal for: Risk-averse investors or short-term goals

Returns: 5% to 8%

Risk Level: Low to Moderate

Tax: Taxed as per holding period

Pros:

- More predictable returns

- Less affected by stock market fluctuations

- Better than FD in some cases

Cons:

- Lower returns compared to equity

- Credit risk in some debt funds

Best For: Short-term goals like buying a car, vacation, or emergency funds.

3. ELSS SIP – Best for Tax Saving

ELSS (Equity Linked Saving Scheme) SIPs invest in tax-saving mutual funds.

Ideal for: Tax savers & long-term investors

Returns: 10% to 14%

Risk Level: Moderate to High

Tax Benefits: Up to ₹1.5 Lakh under Section 80C

Lock-in Period: 3 years (shortest among tax-saving instruments)

Pros:

- Dual benefit: Tax saving + wealth creation

- Higher returns than traditional tax-saving tools like PPF

- Short lock-in period

Cons:

- No liquidity for 3 years

- Market-dependent performance

4. Flexi SIP – Flexible Investment

In Flexi SIP, you can change the SIP amount based on market condition or your cash flow.

Ideal for: Freelancers, variable income earners

Returns: Depends on fund + timing

Risk Level: Moderate to High

Pros:

- Customize amount as per need

- Useful in volatile markets (invest more when market is low)

Cons:

- Requires active tracking

- Not fully passive like fixed SIP

5. Top-Up SIP – Smart Way to Increase SIP Over Time

With Top-up SIP, you can increase your monthly SIP amount automatically every year.

Ideal for: Salaried individuals with growing income

Returns: Better than static SIPs in long-term

Risk Level: Moderate to High

Pros:

- More investment = more compounding

- Automatically grows your investment

Cons:

- Higher monthly burden later

- Needs proper financial planning

Example: Start with ₹2,000/month and increase by ₹500 every year.

6. Goal-Based SIP – Target Specific Financial Goals

These SIPs are aligned with your goals like:

- Child’s education

- Retirement

- Buying a house

You choose mutual funds based on timeline & risk appetite.

Ideal for: Financial planning mindset

Returns: Depends on goal horizon

Risk Level: Flexible

Pros:

- Focused investing

- Clear purpose = more discipline

Cons:

- Needs proper fund selection

- Requires clarity of goal timelines

Quick Comparison Table:

| SIP Type | Risk Level | Returns | Tax Benefit | Ideal For |

|---|---|---|---|---|

| Equity SIP | High | 10–15% | No | Long-term wealth |

| Debt SIP | Low | 5–8% | No | Short-term safety |

| ELSS SIP | High | 10–14% | Yes | Tax savers |

| Flexi SIP | Medium | Varies | No | Freelancers |

| Top-Up SIP | Medium | High (long-term) | No | Growing income earners |

| Goal-Based SIP | Flexible | Depends | Depends | Targeted planning |

Which SIP Should You Choose?

- Want long-term growth? ➤ Go for Equity SIP or Top-Up SIP

- Need tax saving? ➤ Choose ELSS SIP

- Low risk, short goal? ➤ Pick Debt SIP

- Variable income? ➤ Try Flexi SIP

- Specific goals? ➤ Plan with Goal-Based SIP

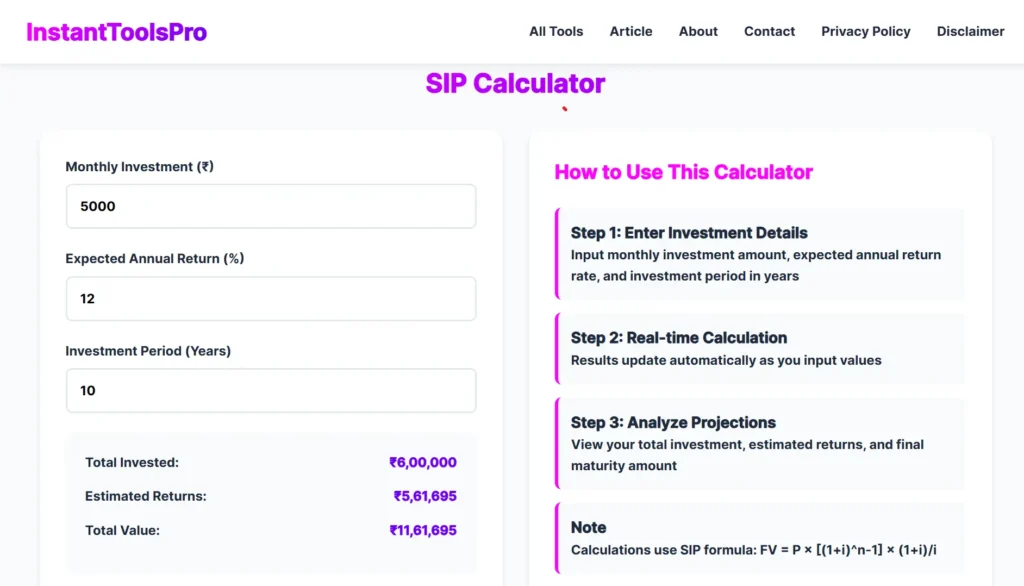

CTA: Use SIP Calculator Now

Want to calculate your ideal SIP amount or returns based on your goal?

Try our Free SIP Calculator at: https://instanttoolspro.com/sip-calculator/

No login, no ads — just instant results!

Conclusion:

There’s no “one best SIP” — only the right SIP for your needs. Understand your financial goals, risk tolerance, and time horizon — and match it with the appropriate SIP type.

Investing regularly in the right SIP can help you become a crorepati, retire early, or even build a strong financial future for your family.

Frequently Asked Questions (FAQs)

Q1: What are the different types of SIP?

Ans: There are several types of SIPs in India such as Equity SIPs, Debt SIPs, ELSS SIPs, Flexi SIPs, Top-Up SIPs, and Goal-Based SIPs. Each one is suitable for different goals and risk levels.

Q2: What happens if I invest ₹5000 per month for 20 years in SIP?

Ans: Investing ₹5000 per month for 20 years in a SIP at 12% annual return can grow to nearly ₹50 lakhs. Use our SIP Calculator to get accurate projections.

Q3: Which SIP is best for me?

Ans: It depends. If you want long-term wealth, go for Equity SIPs. For tax savings, choose ELSS. For low-risk goals, pick Debt SIPs.

Q4: एसआईपी के विभिन्न प्रकार क्या हैं?

उत्तर: SIP के प्रकार हैं – इक्विटी SIP, डेट SIP, ELSS, फ्लेक्सी SIP, टॉप-अप SIP, और गोल आधारित SIP।

Q5: एसआईपी के लिए कौन सी कैटेगरी सबसे अच्छी है?

उत्तर: अगर आप टैक्स बचाना चाहते हैं तो ELSS SIP चुनें, यदि आप सुरक्षित निवेश चाहते हैं तो डेट SIP, और लंबी अवधि के लिए इक्विटी SIP बेहतर है।

![How to Calculate Your Monthly SIP in 2 Minutes [Free Tool Inside]](https://instanttoolspro.com/blog/wp-content/uploads/2025/06/How-to-Calculate-Your-Monthly-SIP-in-2-Minutes-Free-Tool-Inside-2-768x432.webp)