Calculate Interest in Seconds – Quick, Accurate & Hassle-Free!

What is Simple Interest?

Simple Interest Calculator (SI) is a method of calculating the interest charged or earned on a principal amount over a period of time at a fixed rate of interest.

It’s widely used in:

- Personal loans

- Short-term investments

- Micro-financing

- Educational loans

- Bank interest estimates

The formula is:

SI = (P × R × T) / 100

Where:

P = Principal

R = Annual Interest Rate

T = Time (in years)

Why Use Our Online SI Calculator?

Manually calculating interest using formula can be time-consuming and prone to errors. Our Simple Interest Calculator helps you:

Get Instant Results

Avoid Manual Errors

Visualize Interest & Total Amount

Save Time While Making Financial Decisions

Features of Our SI Calculator Tool

🔹 Real-time calculation – Get results as you type

🔹 Clean, user-friendly interface

🔹 Monthly & Annual equivalent rate breakdown

🔹 Mobile responsive and fast

🔹 Absolutely free to use!

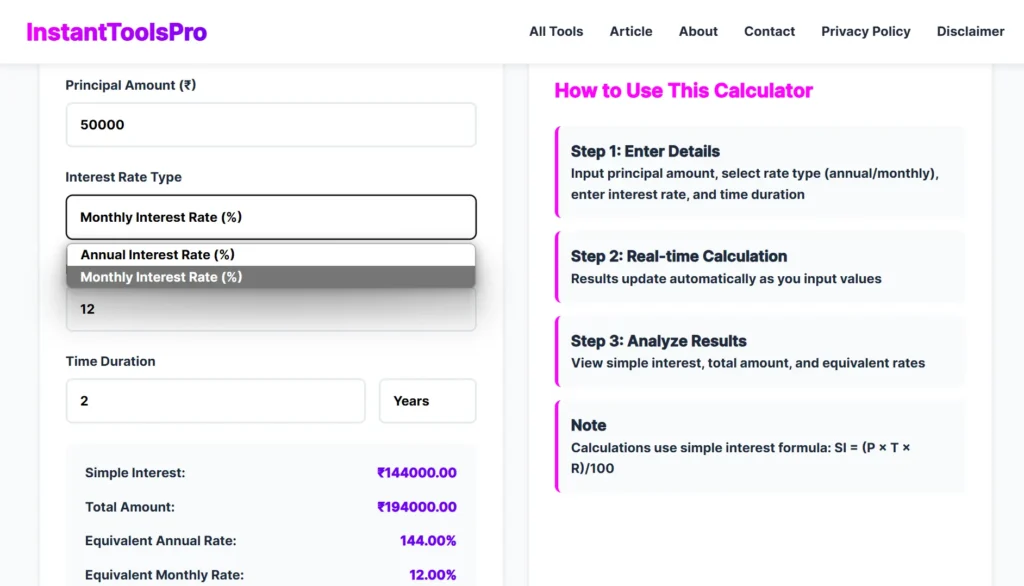

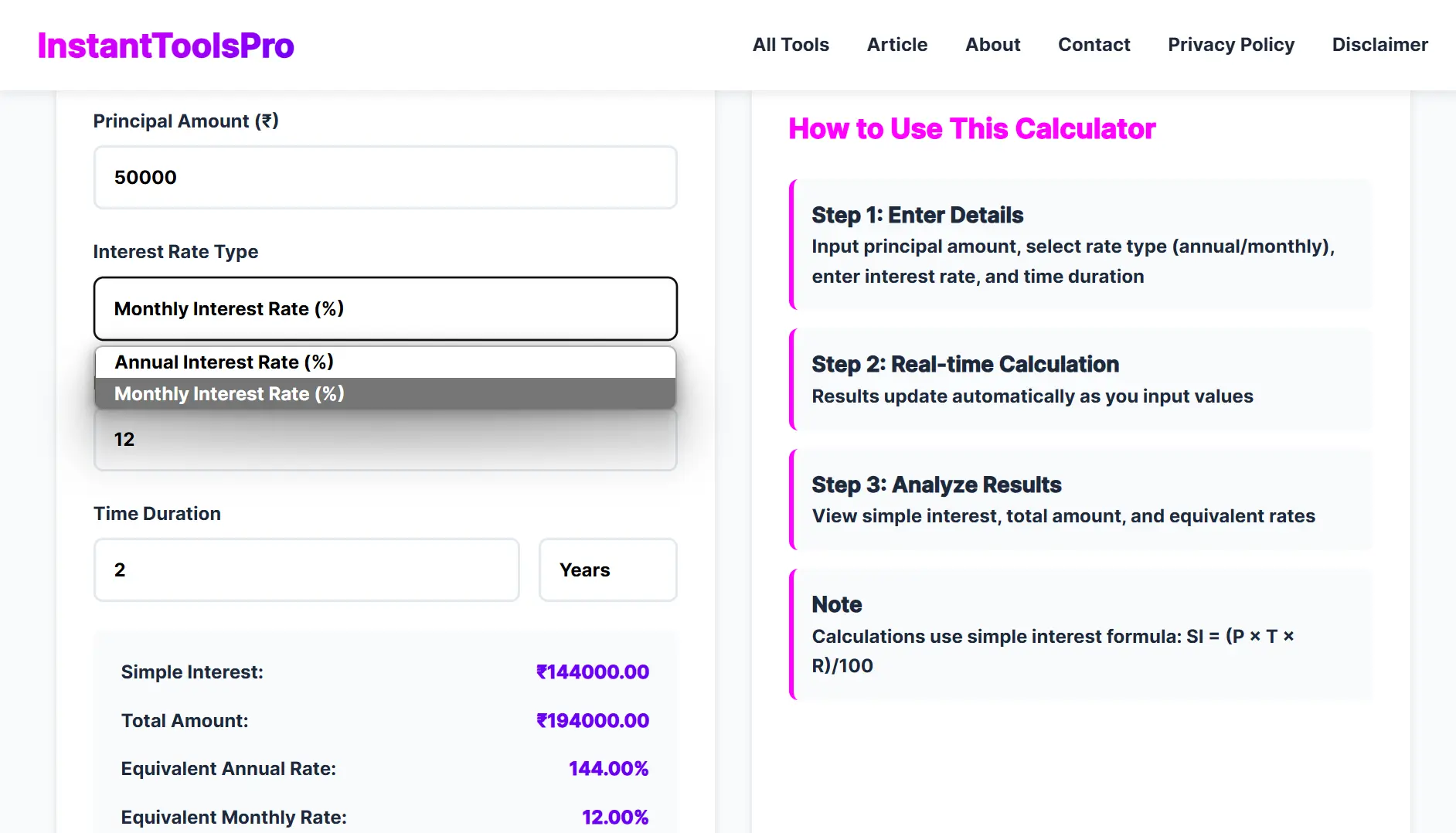

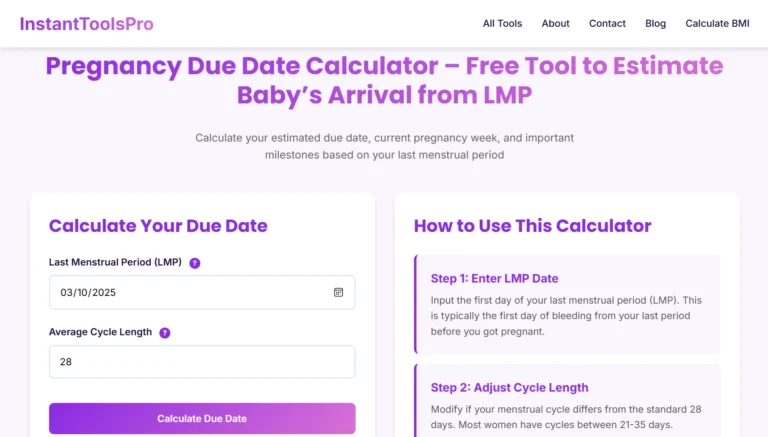

How to Use the SI Calculator

Step 1: Enter the Principal Amount

Step 2: Fill in the Interest Rate (%)

Step 3: Select the Time Duration (Months/Years)

Step 4: Instantly get:

- Simple Interest

- Total Payable Amount

- Equivalent Annual & Monthly Rates

Use Case Examples

🔸 Loan Estimation: Planning to borrow ₹50,000 at 12% interest for 2 years? Use our SI Calculator to know how much interest you’ll pay.

🔸 Student Projects: Perfect tool for students to understand real-world applications of math.

🔸 Financial Planning: Get a quick estimate of returns or dues on investments or borrowings.

Is My Data Safe?

Yes, our calculator is client-side based. We do NOT store any personal data. Your information stays 100% secure.

Try the SI Calculator Now!

Go to Simple Interest Calculator

SEO Benefits of Using This Tool

Using our calculator increases your engagement on site and helps you:

- Save time on financial estimates

- Make informed decisions

- Share the tool with friends or colleagues

Frequently Asked Questions (FAQs)

Q1: Can I use this for bank loan calculations?

Yes. This is ideal for basic loan estimates. However, banks may use compound interest, so double-check for accuracy.

Q2: Is this tool free to use?

Absolutely! No signup, no ads (for now), no fees.

Q3: Can I use it on mobile?

Yes, our tool is mobile-friendly and responsive.

Q4: How accurate are the results?

The tool uses the official simple interest formula and is accurate for all practical purposes.

Really appreciate how the calculator breaks down monthly and annual rates—it’s often tricky to interpret interest across different timeframes, so that’s a useful touch. It definitely helps make quick financial decisions a lot clearer.