Introduction

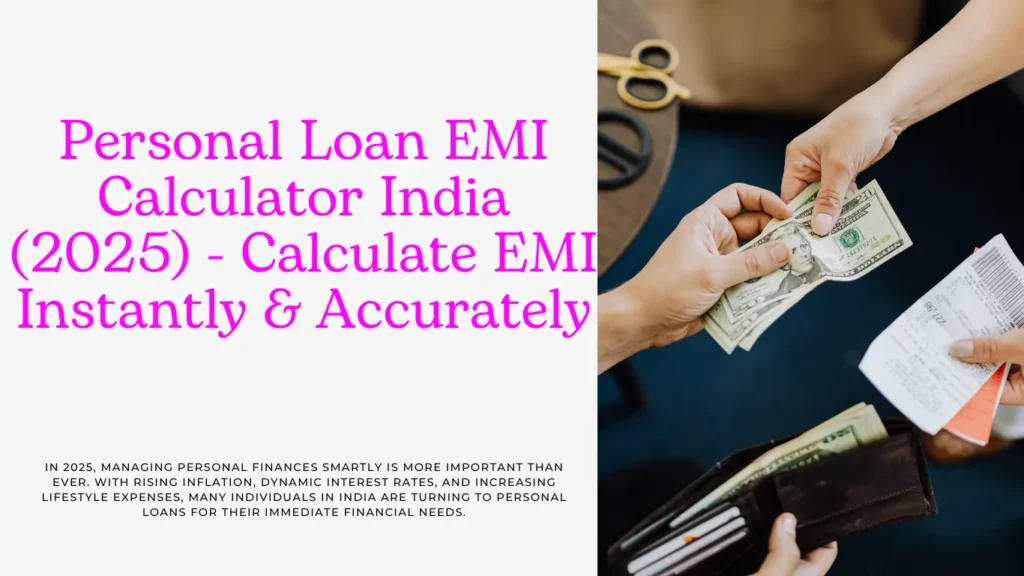

In 2025, managing personal finances smartly is more important than ever. With rising inflation, dynamic interest rates, and increasing lifestyle expenses, many individuals in India are turning to personal loans for their immediate financial needs. Whether it’s funding a medical emergency, planning a wedding, or consolidating existing debts, personal loans are a convenient and flexible option. However, understanding the equated monthly installment (EMI) before committing to a loan is crucial. That’s where a tool like the Personal Loan EMI Calculator India becomes essential. It helps you estimate your EMIs accurately, making your financial planning smoother and smarter.

In this comprehensive guide, we will explore everything about Personal Loan EMI Calculators, how they work, why they are important, and why InstantToolsPro’s Personal Loan EMI Calculator is one of the most user-friendly tools available in India today.

What is a Personal Loan EMI Calculator?

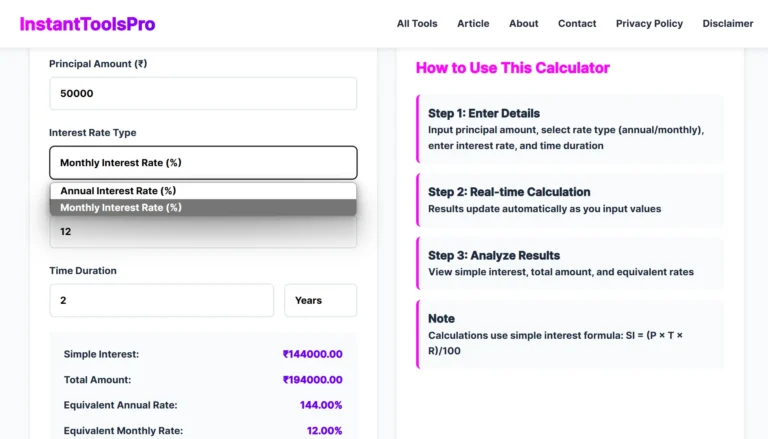

A Personal Loan EMI Calculator is an online tool that helps borrowers estimate their monthly repayment (EMI) based on the loan amount, interest rate, and loan tenure. This calculator simplifies financial planning by showing how much you will pay each month, including the total interest outgo.

Formula used for EMI calculation:

EMI = [P x R x (1+R)^N] / [(1+R)^N − 1]

Where:

- P = Principal loan amount

- R = Monthly interest rate (Annual Rate / 12 / 100)

- N = Loan tenure in months

Instead of calculating manually, InstantToolsPro’s calculator does all the hard work instantly, giving accurate results within seconds.

Why Do You Need an EMI Calculator?

- Instant Calculations: Saves time and effort from manual computation.

- Accurate Results: Eliminates human errors.

- Better Financial Planning: Helps in assessing your monthly budget.

- Compare Loan Offers: Easily compare EMIs for different interest rates and tenures.

- Transparency: No hidden surprises later in your repayment schedule.

Key Features of InstantToolsPro’s EMI Calculator

- User-Friendly Interface: Simple design that works smoothly on mobile and desktop.

- Real-Time EMI Preview: Get results as you change values.

- No Signup Required: 100% free and accessible without registration.

- Zero Ads & Distractions: Unlike other sites that bombard you with ads.

- Unlimited Use: Calculate as many times as you need.

- Flexible Inputs: No fixed limits. Enter any loan amount, tenure, or interest rate.

Try it now: https://instanttoolspro.com/Personal-Loan-EMI-Calculator

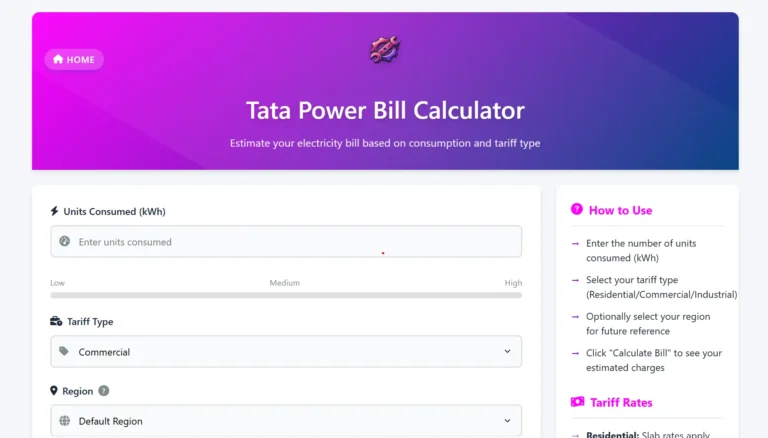

How to Use InstantToolsPro’s EMI Calculator

- Step 1: Enter the loan amount (e.g., ₹1,00,000)

- Step 2: Enter the interest rate (e.g., 11.5%)

- Step 3: Enter loan tenure in months or years (e.g., 36 months)

- Step 4: Instantly see your EMI, total interest payable, and total payment.

You can adjust any of the inputs in real-time to see how your EMI changes, helping you make informed loan decisions.

Personal Loan Use Cases

Some common reasons why Indians opt for personal loans:

- Medical expenses

- Education fees

- Wedding costs

- Travel or vacation

- Home renovation

- Debt consolidation

Regardless of the purpose, knowing your EMI helps in ensuring you don’t overburden your monthly finances.

Why InstantToolsPro Over Other EMI Calculators?

Most websites that offer EMI calculators come with one or more of the following issues:

- Too many ads

- Fixed input ranges

- Confusing UI

- Hidden lead forms for loan companies

- Require personal details

InstantToolsPro.com stands apart because:

- It’s built purely as a productivity tool

- No data collection or tracking

- Tools are free, fast, and designed for user benefit

InstantToolsPro has many other tools like:

…and more. All accessible without signup.

Tips to Reduce Personal Loan EMI

- Choose Longer Tenure: Increases total interest but reduces monthly burden

- Improve Your Credit Score: Helps you get lower interest offers

- Prepay When Possible: Reduces overall interest

- Compare Before You Commit: Use the EMI calculator to test different scenarios

Frequently Asked Questions

Q1: Is the calculator result 100% accurate?

Yes, InstantToolsPro uses the standard EMI formula. Results are as accurate as the values you input.

Q2: Can I use it on mobile?

Absolutely. The tool is mobile-friendly and works without apps.

Q3: Is my data safe?

Yes. No personal data is collected.

Q4: Can I use it for car or education loans?

Yes. As long as you know the interest rate and tenure, it works for any loan type.

Conclusion

Personal loans can be a smart way to meet immediate financial needs — but only if you know what you’re committing to. An EMI calculator gives you clarity and control. In 2025, with rising digital awareness, it’s important to use trustworthy and clutter-free tools.

InstantToolsPro.com offers exactly that — a smooth, accurate, and free experience for anyone needing fast financial calculations.

Before you apply for your next personal loan, head over to:

https://instanttoolspro.com/Personal-Loan-EMI-Calculator and take charge of your finances!

![How to Calculate Your Monthly SIP in 2 Minutes [Free Tool Inside]](https://instanttoolspro.com/blog/wp-content/uploads/2025/06/How-to-Calculate-Your-Monthly-SIP-in-2-Minutes-Free-Tool-Inside-2-768x432.webp)