personal loan EMI calculator India, EMI calculator for personal loan 2025, calculate EMI on ₹5 lakh personal loan, personal loan interest rates comparison India, best personal loan EMI calculator tool

Introduction

Thinking of taking a personal loan in 2025? Whether you’re planning a wedding, paying medical bills, or funding a dream vacation, a personal loan can help — but understanding your EMI is the most important step before applying.

With our Personal Loan EMI Calculator India 2025, you can instantly calculate your monthly payments based on:

- Loan Amount

- Interest Rate

- Tenure

In this guide, you’ll learn:

- How personal loan EMI is calculated

- Examples of EMI on ₹1 lakh, ₹5 lakh, and ₹10 lakh loans

- Interest rates from top banks (SBI, HDFC, ICICI, Axis, etc.)

- Smart tips to lower EMI

- Why our calculator is better than bank websites

What is a Personal Loan EMI?

EMI stands for Equated Monthly Installment — a fixed monthly payment you make to repay your personal loan. It includes:

- Principal amount

- Interest charged by the bank

Formula for EMI:

EMI=P×R×(1+R)N(1+R)N−1EMI = \frac{P \times R \times (1+R)^N}{(1+R)^N – 1}EMI=(1+R)N−1P×R×(1+R)N

Where:

- P = Loan amount

- R = Monthly interest rate (annual rate ÷ 12 ÷ 100)

- N = Loan tenure in months

No need to calculate manually — use our free EMI calculator to get accurate results in seconds!

EMI Examples (₹1L, ₹5L, ₹10L)

Here are sample EMIs for common personal loan amounts at different tenures:

| Loan Amount | Tenure | Interest Rate | Monthly EMI |

|---|---|---|---|

| ₹1,00,000 | 12 months | 10% p.a. | ₹8,792 |

| ₹5,00,000 | 36 months | 11.5% p.a. | ₹16,493 |

| ₹10,00,000 | 60 months | 13% p.a. | ₹22,753 |

Want to know your exact EMI?

Use the Personal Loan EMI Calculator Now

Top Bank Interest Rates for Personal Loans (2025)

Comparing interest rates is key to saving money on EMIs. Here’s a list of current personal loan rates:

| Bank | Interest Rate (p.a.) | Processing Fee | Max Tenure |

|---|---|---|---|

| SBI | 10.15% – 14.55% | ₹1,000 + GST | 72 months |

| HDFC Bank | 10.50% – 21% | Up to 2.5% | 60 months |

| ICICI Bank | 10.99% – 18% | Up to 2.25% | 60 months |

| Axis Bank | 10.49% – 20% | 1.5% – 2% | 60 months |

| Kotak Mahindra | 10.99% – 24% | Up to 2.5% | 60 months |

Use our calculator to check EMI for each bank’s interest rate instantly!

Why Use a Personal Loan EMI Calculator?

Using an EMI calculator before applying for a loan is smart financial planning. Here’s why:

Accurate EMI Estimation

Know exactly how much you’ll pay every month.

Avoid Over-Borrowing

See if you can afford the EMI before committing.

Compare Bank Offers Easily

Try different interest rates & tenures in seconds.

Save Time and Stress

No need for manual calculations or confusing math.

Smart Tips to Reduce Your Personal Loan EMI

Even a 1% reduction in interest can save you thousands of rupees. Here’s how to minimize your EMI:

- Opt for longer tenure (but check total interest)

- Improve your credit score before applying

- Compare banks using our calculator

- Avoid hidden charges (processing fees, late fees)

- Prepay or part-pay when possible

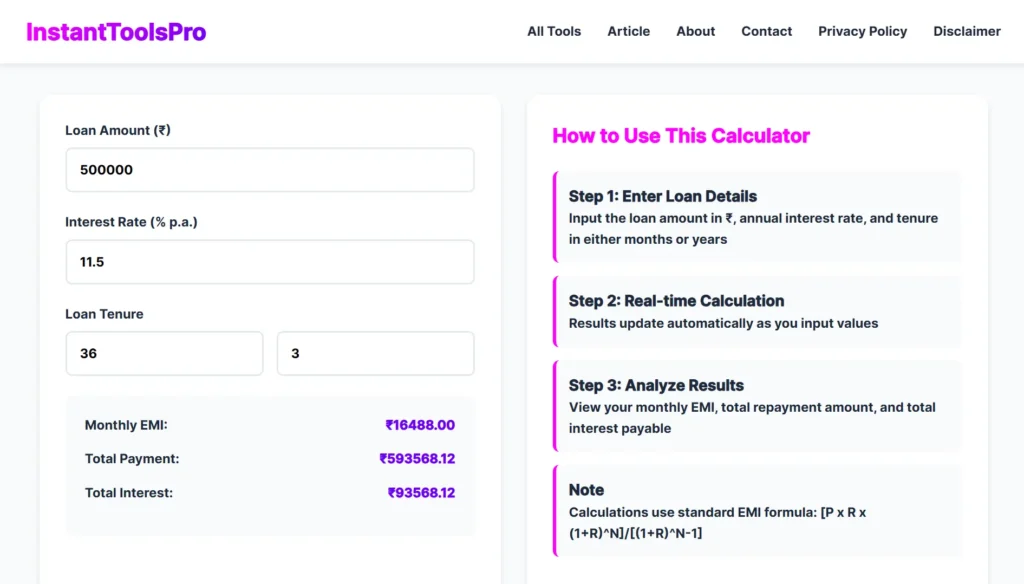

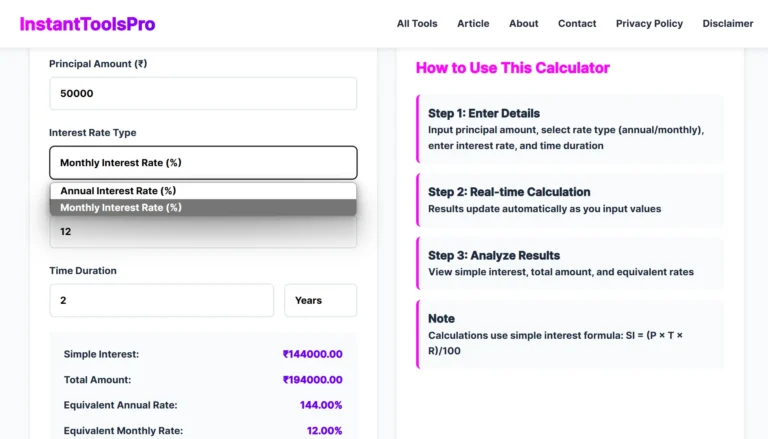

How to Use the Personal Loan EMI Calculator Tool (Step-by-Step)

- 👉 Visit: Personal Loan EMI Calculator

- 💰 Enter your loan amount (e.g., ₹5,00,000)

- 📆 Choose loan tenure (in months or years)

- 📈 Input the expected interest rate (e.g., 12.5%)

- ✅ See your monthly EMI instantly!

You’ll also get:

- Total interest payable

- Total amount repayable

- Option to adjust values in real-time

Example: Calculate EMI on ₹5 Lakh Personal Loan

Let’s say:

- Loan Amount = ₹5,00,000

- Interest Rate = 11.5%

- Tenure = 3 years (36 months)

Your EMI = ₹16,488

Total Interest = ₹93,568

Total Payment = ₹5,93,568

Try this yourself:

Click here to calculate

Who Can Apply for Personal Loans?

- Salaried employees (public & private)

- Self-employed individuals

- Freelancers with income proof

- Pensioners (in selected banks)

🔐 Pro tip: Use the calculator before you apply to plan better.

Frequently Asked Questions (FAQ)

1. What is the EMI for ₹5 lakh personal loan?

EMI depends on tenure and interest rate. For ₹5L @11.5% for 3 years, EMI = ₹16,488/month.

2. Which bank has the lowest personal loan interest rate in India?

SBI and HDFC often offer the lowest rates for eligible applicants with high credit scores.

3. Is personal loan EMI fixed or floating?

Longer tenure = lower EMI, but more interest overall. Choose a balanced tenure (3–5 years).

5. Is it better to take personal loan or use credit card?

Personal loans have lower interest than credit cards, especially for larger amounts.

6. Can I prepay a personal loan early?

Yes, but check for prepayment charges. Some banks allow free part-prepayment after 12 months.

Conclusion

A personal loan can be a powerful tool — if you plan it smartly. Don’t blindly trust what your bank says. Use our free Personal Loan EMI Calculator to:

- Get accurate monthly EMI

- Compare bank interest rates

- Choose the best loan offer

Calculate before you commit.

Try the EMI Calculator Now | Personal Loan EMI Calculator India

2 Comments