Introduction: Understand the Secret Behind SIP Growth

How SIP Works in India: Systematic Investment Plans (SIPs) have become the go-to choice for Indian investors looking to grow wealth steadily without timing the market. But what makes SIPs such a powerful tool? The answer lies in two simple concepts: Rupee Cost Averaging and the Power of Compounding. This article will explain both in an easy and practical way, with examples, so even a beginner can master the SIP journey.

Whether you are investing for retirement, a child’s education, or financial independence, understanding how SIP works is the first step to making smart, long-term decisions.

What is SIP and Why Should You Care?

A SIP (Systematic Investment Plan) allows you to invest a fixed amount regularly (monthly/weekly) in mutual funds. Instead of investing a large lump sum at once, you invest small amounts over time. SIPs are ideal for salaried people, students, and anyone starting their investment journey.

Benefits:

- No need to time the market

- Builds financial discipline

- Easy on pocket

- Offers potential higher returns over long term

1. What is Rupee Cost Averaging?

Rupee Cost Averaging (RCA) is the heart of SIP. When you invest the same amount every month, you buy more units when the market is low and fewer units when it’s high. Over time, your average cost per unit reduces.

Example:

Let’s say you invest ₹1,000/month.

- January NAV = ₹10 ➔ You get 100 units

- February NAV = ₹12 ➔ You get 83.33 units

- March NAV = ₹8 ➔ You get 125 units

Total Invested: ₹3,000

Total Units: 308.33

Average Cost per Unit: ₹3,000 / 308.33 = ₹9.73

Even though prices fluctuated, your average purchase price is lower than the high price.

Why is this good?

- It reduces risk in volatile markets

- Helps build wealth without timing ups and downs

2. Power of Compounding in SIP

Compounding is when your earnings start earning more returns. SIP allows your investment to grow on its own over time. The earlier you start, the greater the effect.

Example:

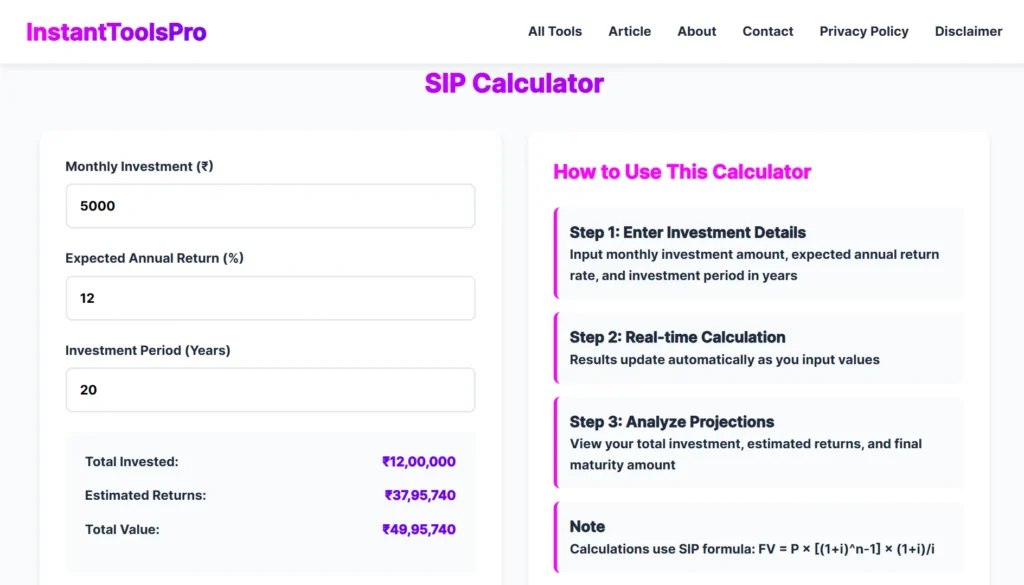

If you invest ₹5000/month for 20 years and earn 12% annual return:

- You invest: ₹12 lakh

- Total Corpus: ~₹50 lakh

That’s the power of compounding. Time is your biggest ally.

Formula:

Future Value = P x [{(1 + r)^n – 1} / r] x (1 + r)

Where:

- P = monthly SIP amount

- r = monthly rate of return (annual rate / 12)

- n = number of months

3. SIP vs One-Time Investment: Which Wins?

SIP may not always give the highest return, but it offers peace of mind and stability.

| Criteria | SIP | Lump Sum |

|---|---|---|

| Risk | Lower (due to RCA) | Higher (timing-based) |

| Suitable For | Beginners, Salaried people | Experienced investors |

| Market Timing Needed | No | Yes |

| Long-term Value | Steady growth | May give higher if timed right |

4. How to Start SIP & Choose the Right Fund

Step-by-Step:

- Choose a reliable mutual fund app (Groww, Zerodha, Kuvera, etc.)

- Complete your KYC (one-time)

- Pick a fund (Large-cap, ELSS, Hybrid, etc.)

- Decide amount & frequency

- Start your SIP & stay invested

Pro Tip: Use our Free SIP Calculator to calculate exact future value & plan better.

5. Common Myths Around SIP

- “SIP is only for long term.” ✓ True, but short-term goals can also benefit.

- “You need a lot of money to start.” ✓ False. Start with just ₹500/month.

- “SIP gives fixed returns.” ✗ False. Returns depend on market and fund performance.

6. SIP Mistakes to Avoid

- Stopping SIP during market fall

- Skipping SIP without reason

- Investing without goal

- Not reviewing performance annually

Conclusion: Make SIP Your Wealth Partner

SIP is not just a tool; it’s a habit that grows with you. With rupee cost averaging and the power of compounding on your side, you can achieve your financial goals peacefully. Don’t wait to invest big. Start small, start now, and stay consistent.

Ready to see your future wealth?

Use our SIP Calculator today and take control of your financial journey!

Read also: How SIP Works in India

- What is SIP? – Explained Simply for Beginners – 2025

- Types of SIPs in India (2025): Which One is Best for You? Equity, Debt, ELSS & More Explained

- How SIP Works in India

FAQ: How SIP Works in India

Q1. What is Rupee Cost Averaging in SIP?

Ans: Rupee Cost Averaging (RCA) is a strategy where you invest a fixed amount regularly, which helps you buy more units when prices are low and fewer units when prices are high. Over time, this averages out the cost and reduces the impact of market volatility.

Q2. How does compounding benefit SIP investments?

Ans: Compounding allows your invested amount and the returns generated on it to grow together over time. In SIPs, staying invested for longer periods helps your wealth multiply exponentially, especially when returns are reinvested.

Q3. Can I benefit from SIP in a falling market?

Ans: Yes! SIPs work better in volatile or falling markets because of Rupee Cost Averaging. You accumulate more units at lower prices, which increases your profit when the market recovers.

Q4. How long should I stay invested in SIP to see good returns?

Ans: Ideally, 5 to 10 years. SIP is a long-term investment strategy. The longer you stay invested, the more you benefit from compounding and reduced market risk.

Q5. Is SIP suitable for beginners?

Ans: Absolutely. SIPs are perfect for beginners due to their flexibility, low starting amount (as low as ₹500), and automated investment method. It instills financial discipline.

Q6. What is the difference between lump sum and SIP?

Ans: Lump sum means investing a big amount at once, while SIP means investing smaller amounts regularly. SIP reduces timing risk and is more suitable for salaried individuals or those with regular income.

Q7. Which tools can help me calculate SIP returns?

Ans: You can use the InstantToolsPro SIP Calculator to instantly check your monthly investment, tenure, interest rate, and estimated future value of your SIP.

![How to Calculate Your Monthly SIP in 2 Minutes [Free Tool Inside]](https://instanttoolspro.com/blog/wp-content/uploads/2025/06/How-to-Calculate-Your-Monthly-SIP-in-2-Minutes-Free-Tool-Inside-2-768x432.webp)