Planning your financial future starts with one smart step — investing regularly. And when it comes to building wealth with discipline and consistency, Systematic Investment Plans (SIP) have become the go-to method for millions. But how do you know how much to invest and what returns to expect?

That’s where the SIP Calculator on InstantToolsPro.com comes in.

What is a SIP (Systematic Investment Plan)?

A SIP is a method of investing in mutual funds where you contribute a fixed amount every month. It helps inculcate a habit of saving and investing regularly without timing the market. It’s like putting your money on autopilot for long-term growth.

Why Use a SIP Calculator?

A SIP Calculator helps you:

- Know how much your monthly SIPs will grow in the long run

- Visualize returns over 5, 10, 20+ years

- Compare scenarios with different interest rates and tenures

- Set realistic financial goals for retirement, education, or a dream home

With our SIP calculator, you don’t need to know complex formulas or do manual math. Just enter your monthly investment, expected annual return (in %), and investment duration in years — and boom! You get instant results.

SIP Calculation Formula

Though you don’t need to do this yourself (thanks to the calculator!), here’s the formula behind the scenes:

FV = P × [ (1 + r)^n – 1 ] × (1 + r) / rWhere:

- FV = Future Value of Investment

- P = SIP amount

- r = Monthly rate of return

- n = Number of SIP payments

How to Use Our Free SIP Calculator?

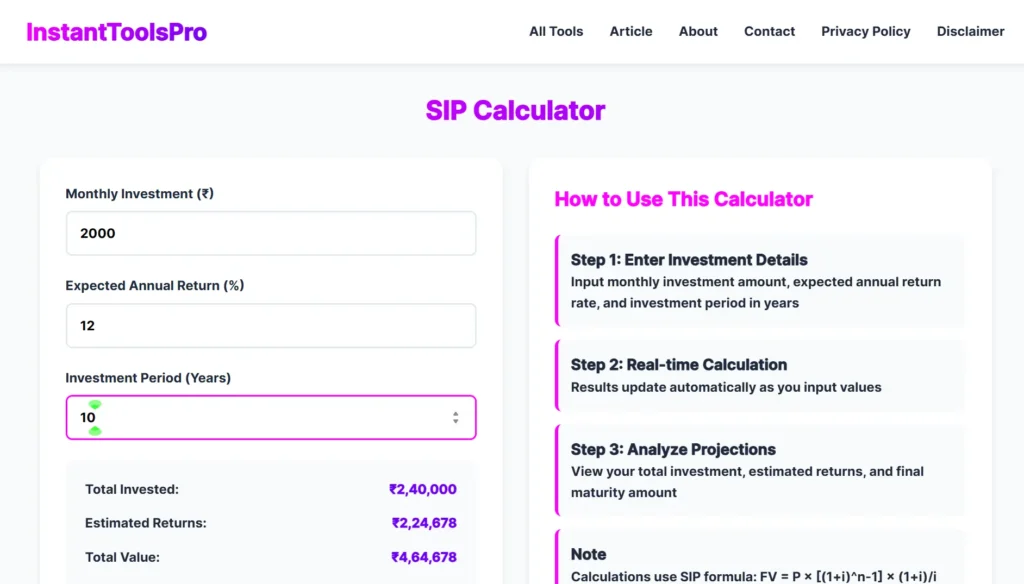

Go to instanttoolspro.com/sip-calculator/

- Enter your monthly SIP amount (₹500, ₹1,000 or any amount)

- Choose the expected annual return (usually between 10-15%)

- Select the number of years you plan to invest

You’ll instantly see:

- Total Invested Amount

- Estimated Return

- Future Value of Investment

Example: ₹2000 SIP for 10 Years

- Monthly SIP: ₹2000

- Expected Return: 12% annually

- Duration: 10 years

🔍 Result: Your total investment of ₹2.4 lakhs could grow to over ₹4.6 lakhs!

Benefits of Using SIP

- Rupee Cost Averaging – buy more units when prices are low

- Power of Compounding – earn interest on interest

- Low Entry Barrier – start with as low as ₹500

- Disciplined Approach – invest automatically every month

SIP vs Lump Sum: What’s Better?

While lump sum gives higher returns if timed right, SIP spreads risk across time. SIPs are perfect for salaried individuals and those who prefer a stress-free investing approach.

Want to Reach ₹1 Crore with SIP?

Use the calculator to reverse-calculate how much SIP is needed every month. You can even test for various return rates (10%, 12%, 15%) and see how early you can reach your goal!

Tools You Might Also Like on InstantToolsPro.com

- Personal Loan EMI Calculator

- Pregnancy Due Date Calculator

- QR Code Generator

- GST Calculator

- BMI Calculator

Final Thoughts

Your financial goals are only as strong as your planning. Use our free SIP Calculator at InstantToolsPro.com to stay on top of your investment game and grow your money smartly and consistently.

Start small. Stay consistent. Let compounding work its magic.