In the fast-paced world of finance, education, and professional planning, time is money. Whether you’re a student trying to solve math homework or a working professional planning for a loan or investment, calculating simple interest is a fundamental need. Traditionally, calculating interest required manual formulas or basic calculators. But in 2025, there’s a faster, easier, and more accurate way: InstantToolsPro’s Simple Interest Calculator.

What Is Simple Interest?

Simple interest is the easiest form of interest calculation. It’s based on the original principal amount, the rate of interest, and the time for which the money is borrowed or invested.

Formula:

Simple Interest (SI) = (Principal × Rate × Time) / 100

Where:

- Principal = the original amount

- Rate = annual/monthly interest rate (in %)

- Time = number of years (or months converted to years)

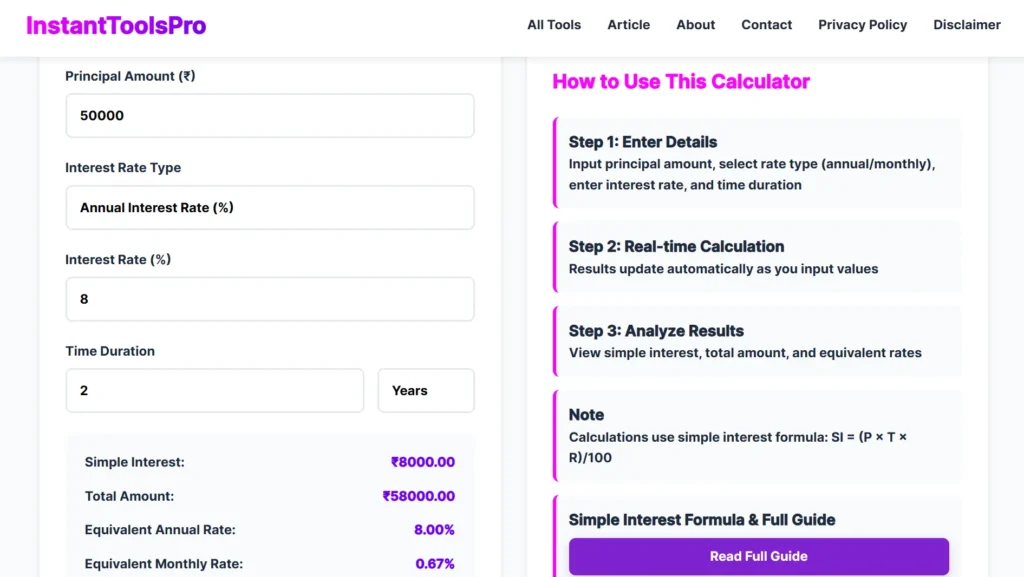

Example: If you borrow ₹50,000 at an annual interest rate of 8% for 2 years, the simple interest will be:

SI = (50000 × 8 × 2) / 100 = ₹8,000

Why Manual Calculations Are Risky

Manual calculation might seem easy, but errors are common when:

- You misplace a decimal point

- Use different units for time (months vs years)

- Forget to convert interest rates

- Use a regular calculator that lacks guidance

Especially in financial planning or academic exams, a small error can lead to big consequences.

Meet InstantToolsPro’s Simple Interest Calculator

To make life easier, InstantToolsPro developed a completely free and instant-use tool to calculate simple interest without any hassle.

Key Features:

- No login required

- Mobile and desktop-friendly

- Works with any input: high or low values

- Zero limitations on interest rate or duration

- Instant results

Who Can Use This Tool?

This calculator is built for everyone, including:

Students

- Solve math assignments quickly

- Understand interest calculations better

- Prepare for competitive exams (like SSC, Banking, etc.)

Professionals

- Loan officers and bankers for quick quotes

- Financial advisors for interest projections

- Small business owners planning finances

Real Estate Buyers

- Estimate interest on home or plot loans

- Plan repayments more effectively

Investors

- Know the return on lending money

- Compare bank deposit offers

How to Use the Simple Interest Calculator (Step-by-Step)

- Go to: https://instanttoolspro.com/si

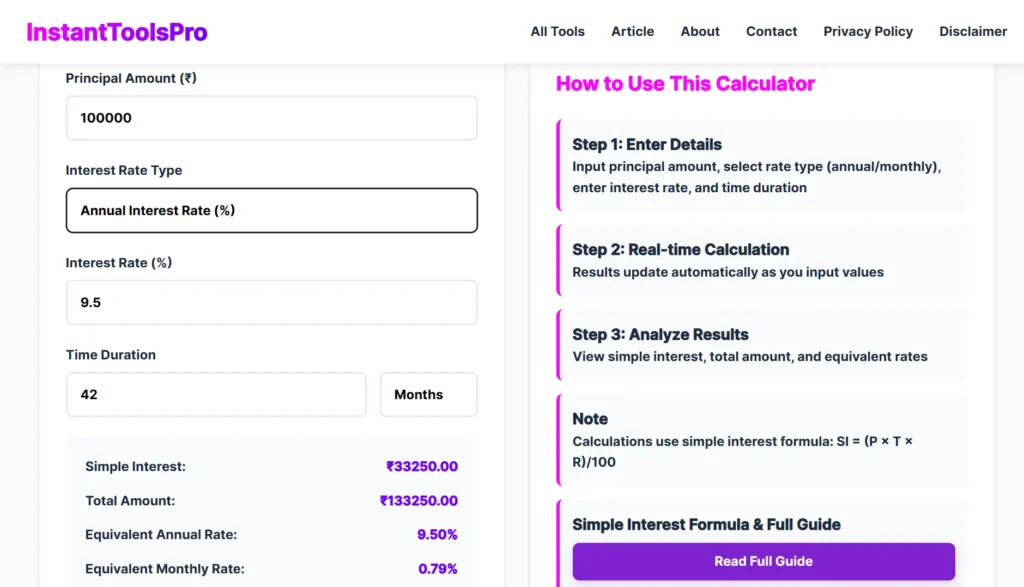

- Enter the Principal amount (e.g., 100000)

- Enter the Rate of Interest (e.g., 9.5)

- Enter the Time Period (e.g., 3.5 years or 42 months

You will instantly see:

- Simple Interest amount

- Total amount to be repaid (Principal + Interest)

Why InstantToolsPro Is Better Than Others

Unlike many online calculators, InstantToolsPro:

- Doesn’t force you to sign up

- Has no ads or distractions

- Allows flexible decimal and unit input

- Loads lightning fast

- Has zero hidden charges

Many other calculators restrict the rate or time,or require monthly logins and app installs. InstantToolsPro is 100% browser-based and always free.

Use Cases You Should Know

- Banking Exams: Practice SI questions without wasting time on pen-paper

- Loan Evaluation: Whether you’re buying a car, bike, or plot, this helps estimate real cost

- Lending Money: Calculate fair interest on personal lending

- Educational Projects: Use it in student projects or presentations

Pro Tip: Use with Other Tools

InstantToolsPro also offers other financial calculators like:

These can be used together for full financial planning!

Final Thoughts

In 2025, you shouldn’t be wasting time manually calculating simple interest. Whether you’re a student solving questions, a buyer estimating loans, or a professional planning investments, InstantToolsPro’s Simple Interest Calculator gives you accurate results in seconds.

It’s fast. It’s free. It’s future-ready.

Try it now: https://instanttoolspro.com/si

#SimpleInterest #InterestCalculator #InstantToolsPro #FinanceTools #LoanPlanning

![How to Calculate Your Monthly SIP in 2 Minutes [Free Tool Inside]](https://instanttoolspro.com/blog/wp-content/uploads/2025/06/How-to-Calculate-Your-Monthly-SIP-in-2-Minutes-Free-Tool-Inside-2-768x432.webp)